- BACKGROUND

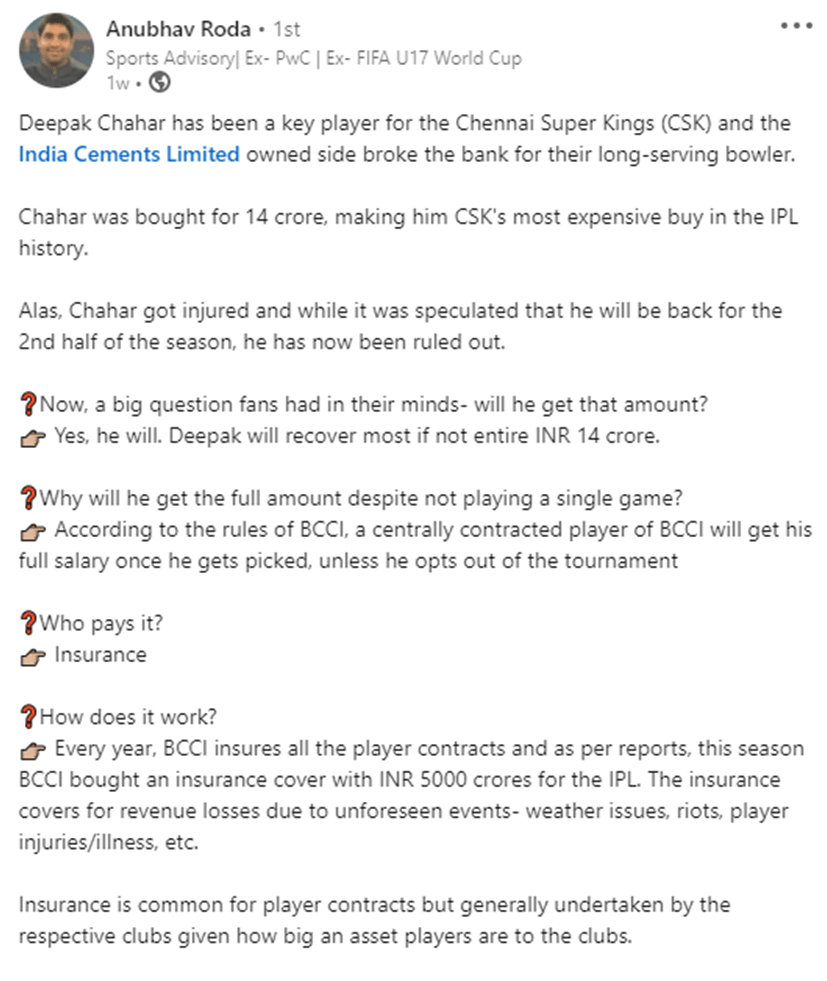

I came across a post by Mr Anubhav Roda, a seasoned sports professional, where he has beautifully explained the mechanism followed in the case of payment of Chennai Super Kings’s strike bowler Deepak Chahar’s mammoth league fees despite his absence from play due to injury, in the 2022 season of the Indian Premier League. He shared the insurance protocol and mechanism followed by the concerned bodies to pay the athlete who misses out on playing due to a disability. It caused me to wonder, how insurance plays around in the Sports industry and even more importantly, what are the unorthodox insurance policies adopted in the Sports industry. This article will be talking about the creative insurance policies adopted by the sports industry, stakeholder’s impact as well as the legal risks of insuring sports.

- INTRODUCTION

Professional sports have developed into a very sophisticated business. Saying the words “professional sports” carries with it the booming sound of risk. Whatever the sport be, the athlete or player has aimed at performing at high levels in challenging environments. Risks arise in a variety of ways: there are risks of injury and death, there are risks of property damage, there are risks of legal liabilities to third parties, and there are risks of financial loss. Insuring against the risks involved in sports has arguably never been more important. The amount of money now at stake, the scale and sophistication of tournaments, and the global geopolitical landscape have all helped elevate risk levels.

- STAKEHOLDERS PERSPECTIVE

Leagues

here are two different types of league programs: one for the benefit of players and the other for the benefit of teams. From what it seems Indian sports bodies operate league-administered insurance plans for the benefit of players in cases of disability. These plans require teams to contribute money each year towards post-career health or disability plans. Some of the plans are optional, yet in others, the players accrue accounts to be used in the case of health problems under the plans based on their years of experience in the league. It is indisputable that a key to success for the leagues is sustainable fan knowledge and admiration for players and teams. One important factor in such continuity is the health of the players. The league’s success depends very much on the success of its recognized stars. Creating a league-wide program, whereby each team contributes to the premium costs, allows teams to have insurance coverage where they might otherwise be taking unnecessary risks.

Teams

Teams use disability insurance policies to help protect against the fact that in most cases if a highly paid player is injured, the team must still pay him. As a result, insurance policies help to reduce the risk of having a large financial obligation. It can help prevent contract disputes and holdouts, situations teams certainly try to avoid. Conceivably, if a player has a policy that allows him to recover a considerable sum of money despite not having agreed to a long-term contract, he is less likely to feel the need to hold out and demand a new contract for the relief of the team. In addition, teams have no interest in seeing players hurt and uncompensated.

Athletes

In general, contracts in professional sports leagues are guaranteed, relieving a player of any concern about the probability of his future earnings. However, before a player signs a major contract, they most likely have many worries about the possibility of a major payday. Considering the injury and success rates in professional sports, one of the athlete’s best tools for protecting themselves against the possibility that an injury will derail their career is disability insurance. Disability insurance can provide a player with the assurance that they need not rush to accept a subpar contract offer and can continue to play at maximum effort without fear of a financially crippling injury.

- CREATIVE OPTIONS

Although Insurance in sports is not well focused in India and most of the insurance policies are purchased by the boards/federations/association, it should be noted that there are other alternative options as well. Considering the salaries of professional athletes, investments made into their performance, and their potential earnings, it is not surprising that both teams and players seek insurance for such revenue. We will here discuss some of the creative options used in form of insurance policies and the perspectives of the individuals and organizations involved in professional sports, which are as follows:

Temporary Disability Policies

A disability is temporary if it “exists until an injured worker is as far restored as the nature of the injury will permit.” A temporary disability policy allows the insured to recover during the time in which the insured or the subject of the insurance is unable to work. In the sports context, this is a policy, which is typically only used by a team and not the player. The goal or purpose of a team purchasing a temporary disability policy is to provide protection in a situation where a player suffers a serious, but less than career-ending injury. Considering that most contracts are guaranteed in professional sports, teams are still obligated to pay injured players. Consequently, teams may take out insurance on some of their higher-priced players, such that if that player is unable to play, at least the team does not have to pay all of his salaries.

Let’s take for example the case of Deepak Chahar. Deepak Chahar has been ruled out of on-field action for three months due to a back injury. He was bought back by the defending champions Chennai Super Kings(CSK) for a staggering INR 14 crore at the two-day mega auction in February. Unfortunately for Chahar, he suffered a quadriceps tear in the same month during a home T20I against the West Indies for which he had to undergo rehabilitation at the National Cricket Academy (NCA) in Bengaluru. While recovering from that injury, he sustained a back injury which ruled him out of the entire season. Had the BCCI not got league-wide insurance, CSK would have protected its interest by getting a Temporary Disability Policy. Since Deepak has a guaranteed contract with CSK, CSK must protect its interest by getting a policy to cover the 14 crore payment, for the services not rendered.

“Key-Man” Insurance Policies

Key-man insurance is a relatively new insurance arrangement that in the sports industry would provide benefits to probable playoff teams that do not make the playoffs as a result of an injury to a star player, or “key-man.” Based on team expectations, in the preseason, an insurance company will offer to reimburse the amount of a typical postseason game’s revenues if an agreed-upon star player misses a certain number of games during that season. Teams might also use insurance policies that allow them to recover for future lost playoff game revenues resulting from losing a playoff game at home.

Now consider a situation where the five-time champions IPL franchise Mumbai Indians were considered to be a prime candidate to make the finals since the team had made the playoffs continuously as well as had an amazing auction with key players Jofra Archer being purchased by the franchise. An injury to pace master, Jofra Archer, in the first game of the season left Archer unavailable for the remainder of the season. Perhaps in part because of Archer’s absence, the Mumbai Indians failed to make the playoffs. If they had “key-man” insurance, they could have recovered an amount equal to the projected revenues from that missed playoff match and other follow-up projected revenue.

Loss of Value Insurance

In general, insurance companies are reluctant to provide coverage on these types of policies. A “loss of value” policy may work in different ways, in the first example, the policy requires a player to miss a certain amount of games but includes a threshold amount of value lost based on the player’s most recent contract offer. In the second type of “loss of value”, a maximum benefit amount is agreed to and if the player receives an offer for less than that amount and the reason for the reduction is because of sickness or injury the insurance company agrees to pay the difference between the highest offer and the maximum benefit amount.

Insurance companies offer contingent personal accident policies meant to protect a player’s anticipated auction and consequent compensation. The policy does not require that the player miss a particular number of games, but instead requires that for coverage to apply, the injury must be serious and lasting. In order to be serious, the injury must negatively affect the player’s skills in a manner that causes substantial and material deterioration in his or her ability to perform; the illness must negatively affect his or her skills permanently. The insurance contract requires that if benefits are paid and the player ends up earning an amount that, combined with the benefits paid exceeds the anticipated compensation within a specified number of years, the player must return the excess amount of benefits he received

- LEGAL RISKS OF INSURING SPORTS: NON-DISCLOSURE AND MISREPRESENTATION

As the insurer knows relatively little about the risk and the insured knows a great deal about the risk, the insured is under a dual-duty to ensure that he or she fully discloses to the insurer all material information relating to the risk of which the insured is aware or ought to be aware and to ensure that he or she does not misrepresent material information. Issues of non-disclosure and misrepresentation regularly arise in respect of insurance claims; this includes sports insurance claims. In order to deal with such legal risks, the insured must ensure that the material information provided to the insurer is complete and accurate. The player must remember that if the information provided to the insurer is contradicted by the information available elsewhere (for example on the player’s own webpage), the player is at risk of losing his or her cover. The duties are just as important as far as corporate insureds are concerned: they must ensure that any representation, for example compliance with regulatory requirements, is accurate.

- CONCLUSION

If something goes wrong in professional sports and there is an insurance policy, it should not be assumed that the policy represents money in the bank. Things can go wrong under the policy, just as much as things can go wrong in sports. There are legal risks concerning any claim under an insurance policy, whether the policy insures professional sports or anything else. Those risks must be managed and they can be managed in a large part by two important steps: clarifying and understanding the scope of the insurance cover and ensuring the risk is presented fairly to the insurer. The careful use of language in defining the scope of cover and the careful presentation of the risk to the insurer are two important considerations which arise in connection with insurance cover for professional sports. They are, however, not the only considerations. Sports are big business and insurance is about the transfer of risk from one business to another business. Professional sportspersons will not be treated as consumers in such cases and therefore the principles of insurance law will apply as they apply to any commercial entity. The legal risks relating to insurance cover must be negotiated like any risk arising from the professional sport. Insurance is used to manage the risk of loss or injury in sports. Legal risks relating to the insurance against such risks must also be managed.